Everyone deserves a chance

We're empowering change-makers in developing countries with micro-loans to thrive

*Initial funding round*

The Problems

1

Financial Exclusion

Limited access to banking and financing options prevents entrepreneurs from escaping poverty and starting ventures.

2

Banking Limitations

Banks view small loans as high-risk and low-profit, leaving low-income entrepreneurs and small businesses without resources.

3

Stagnation

Inaccessible capital for individuals and small businesses leads to stagnant local economies and a poverty cycle.

Our solution

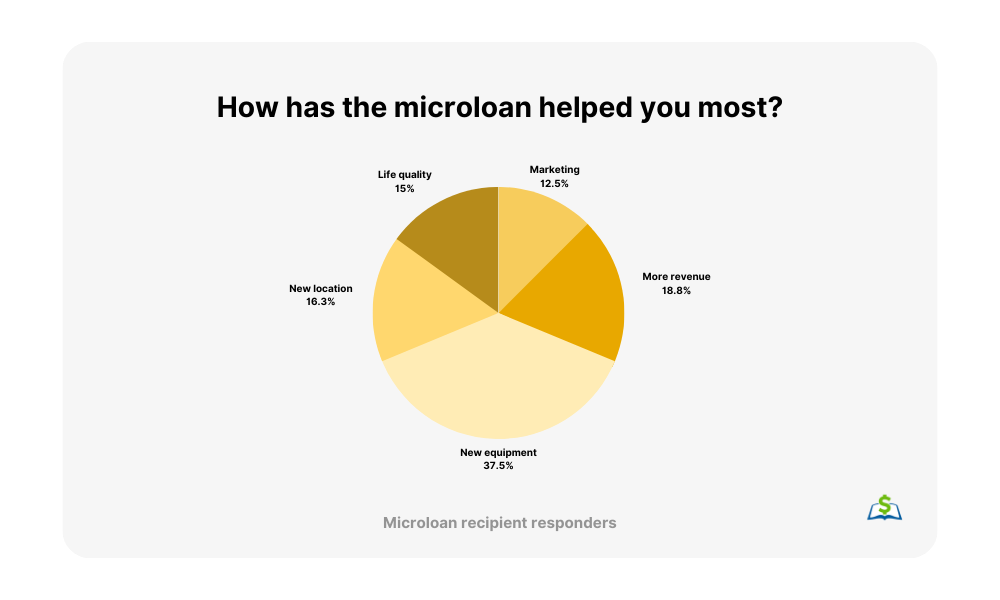

We're providing custom micro-loans designed to help achieve specific goals and overcome financial challenges. Then, we offer consulting to ensure goal success.

Maria's Story

Maria runs a small snack cart in South America. She pushes her cart and sells chips from dusk till dawn making a living. A YFF microloan set her ahead of payments and is helping her launch her dream of a restaurant.

$5,000 total initial micro-loan funding

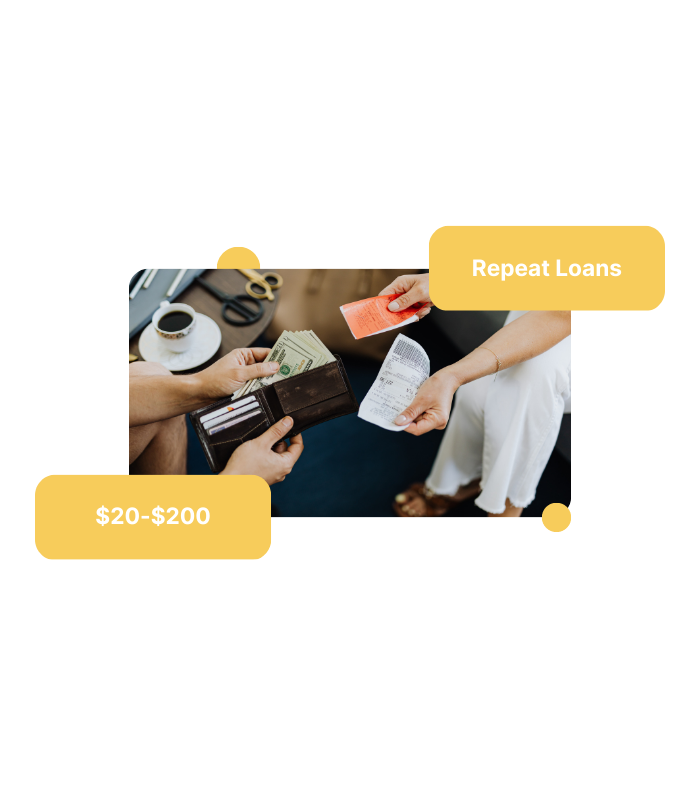

Tailored microloans

Dependent on your needs, we'll provide micro-loans averaging $200. Repeat loans are possible with a history of repayment.

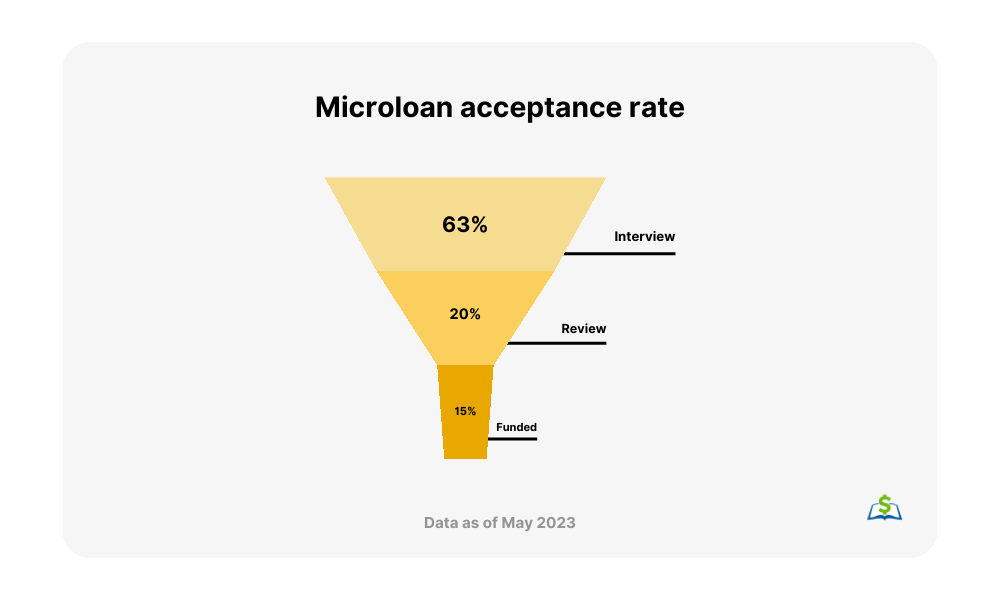

3 Step Process

Apply

02

Consult

We'll set up a 30 minute consultation to determine what you need, how much you need, and why you need it.

Monitor

After the consultation, money will be sent to you and repayments will be monitored.

Personalized support

Aside from just funding, we'll consult you on a frequent basis to bring you closer to your goals and on track to a sustainable financial future.

Microloan Philosophy

Financial empowerment is a key catalyst for sustainable progress and development. Millions of people in underdeveloped countries face challenges accessing financial resources to pursue their own ventures. We're bridging this gap by providing microloans to budding changemakers, fostering a positive cycle of growth.

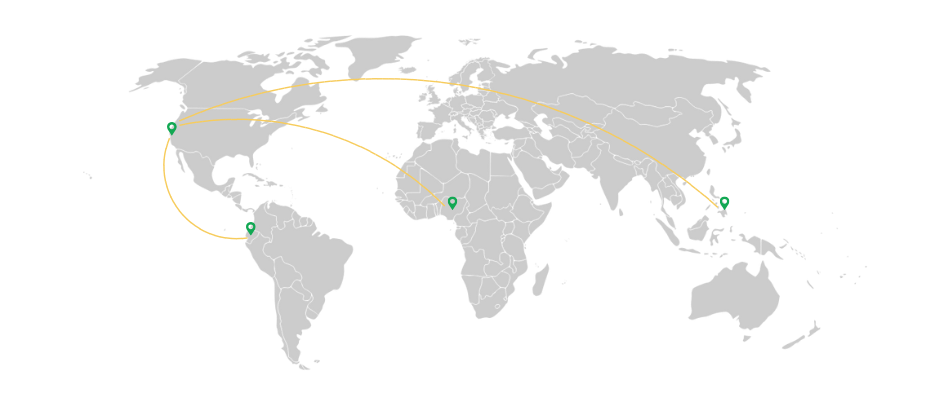

Leveraging Local Leaders

We're also collaborating with local leaders in communities around the world to make a direct impact with microloan funding

Frequently Asked Questions

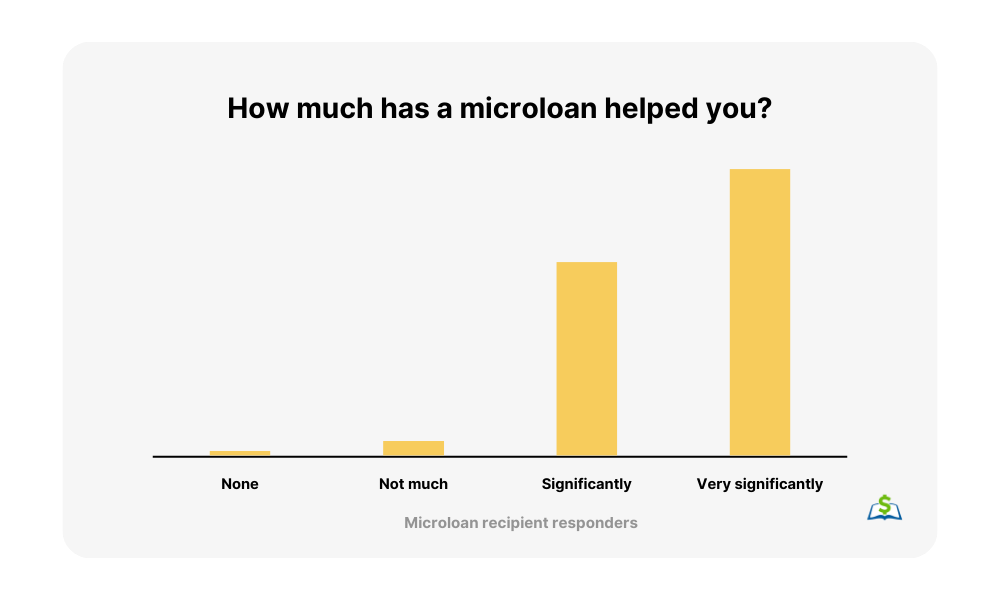

Make a real difference by lending money

Historically, microloans have a 96% repayment rate

Youth for Finance

Copyright © 2024 Youth for Finance. All rights reserved.

Email: [email protected]

PO: 3000 Geary Blvd San Francisco, CA 94118